sales tax on leased cars in texas

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The minimum is 625 in Texas.

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

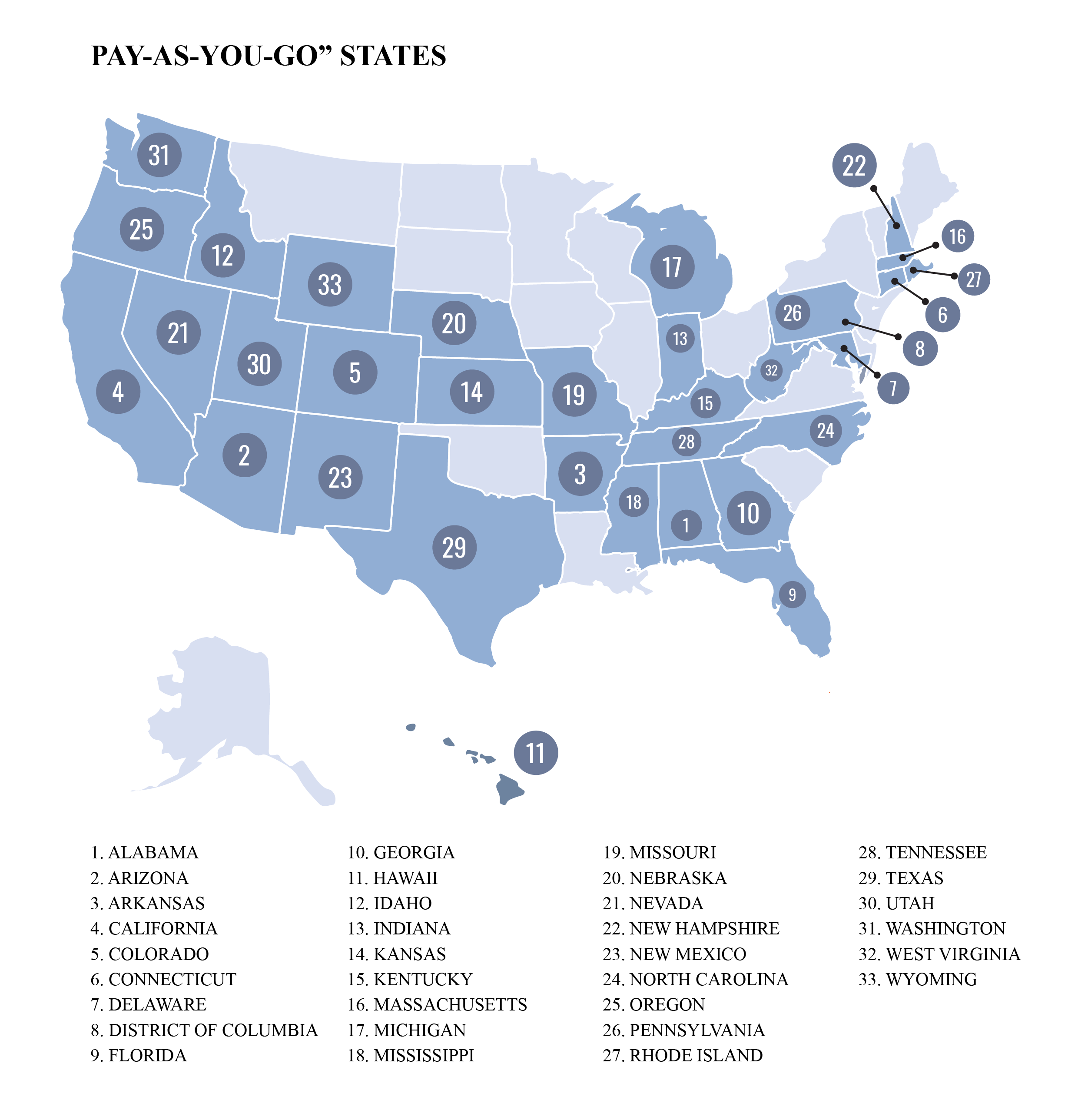

In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were.

. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. The sales tax for cars in Texas is 625 of the final sales price.

Posted on April 17. The sales tax differs from state to state. Sales tax is a part of buying and leasing cars in states that charge it.

A Except for purchases by franchised dealers described in this subsection motor vehicles that are purchased by a lessor to be leased are. Trade Difference 20000. Sales tax on leased cars.

In addition Chicago levies an 8 percent use tax on leased vehicles on top of the sales tax. Like with any purchase the rules on when and how much sales tax youll. With the new Illinois tax law a sales new tax will be applied to a trade-in value.

Vehicles purchases are some of the largest sales commonly made in Texas which means that they can lead to a hefty sales tax bill. Except as provided by this chapter the tax is an obligation of and. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

Texas law requires the owner the leasing company to pay sales tax on the total value of a vehicle they buy from a dealership and rent to a renter you and me. Sales tax is a part of buying and leasing cars in states that charge it. Car youre trading 30000.

Car youre buying 50000. A A tax is imposed on every retail sale of every motor vehicle sold in this state. The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local.

Heres an explanation for. Multiply the vehicle price after trade-in andor incentives by the sales tax. A lessee who purchased a leased vehicle brought into Texas may claim a credit for either the use tax or the new resident tax paid by the lessee against any tax due on its purchase.

Texas residents 625 percent of sales price less credit for. States charge sales tax on the total value of the vehicle. Texas Sales Tax on Car Purchases.

For example in Texas youll have to pay 90 a year in. Motor Vehicle Leases and Sales. In the state of Texas you pay 625 tax on Trade difference.

Modernizing Rental Car And Peer To Peer Car Sharing Taxes

The Top Is There Sales Tax On A Leased Car In Texas

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Are You Cash Negative At The Inception Of A Bhph Deal Due To Sales Tax Lhph Capital

The Top Is There Sales Tax On A Leased Car In Texas

Chrysler Dodge Jeep Ram And Wagoneer Dealer Huntsville Tx New Used Cars For Sale Near Madisonville Tx Wischnewsky Dodge

Do You Pay Sales Tax On A Lease Buyout Bankrate

The Top Is There Sales Tax On A Leased Car In Texas

Texas Sales And Use Tax Exemption Cert Olden Lighting

Maserati Lease Purchase Specials In Dallas Maserati Dallas An Avondale Dealership

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Do You Pay Sales Tax On A Lease Buyout Bankrate

Used 2018 Club Car Carryall 1700 Utility Vehicle For Sale In Texas City Tx United Rentals

Used Cars In Texas For Sale Enterprise Car Sales

Leasing A Car And Moving To Another State What To Know And What To Do

Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation Unt Digital Library

:max_bytes(150000):strip_icc()/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-6ccebddf50af4f7ba914398272f2ad46.jpg)